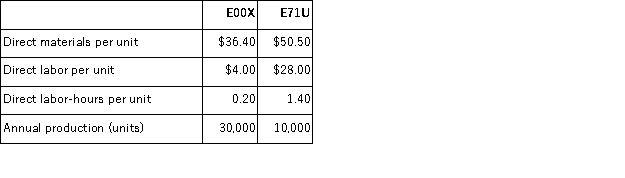

(Appendix 4A)Hoffhines Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products, E00X and E71U, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $1, 021, 200 and the company's estimated total direct labor-hours for the year is 20, 000.

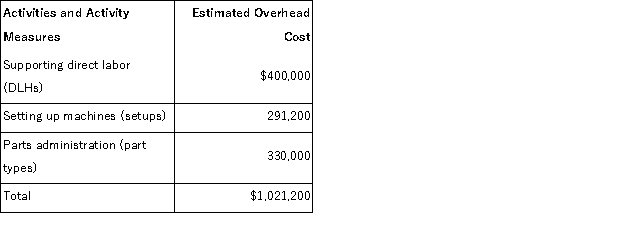

The company's estimated total manufacturing overhead for the year is $1, 021, 200 and the company's estimated total direct labor-hours for the year is 20, 000.

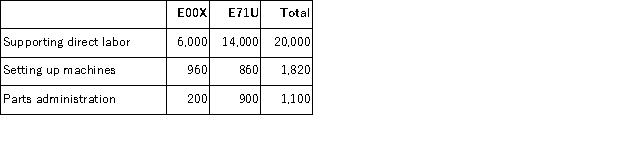

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: (Appendix 4A)Pacchiana Manufacturing Corporation has a traditional

Q2: (Appendix 4A)Delaware Manufacturing Corporation has a traditional

Q3: (Appendix 4A)Riha Manufacturing Corporation has a traditional

Q5: (Appendix 4A)Binegar Manufacturing Corporation has a traditional

Q6: (Appendix 4A)Kebort Manufacturing Corporation has a traditional

Q7: (Appendix 4A)Pacchiana Manufacturing Corporation has a traditional

Q8: (Appendix 4A)Koszyk Manufacturing Corporation has a traditional

Q9: (Appendix 4A)Binegar Manufacturing Corporation has a traditional

Q10: (Appendix 4A)Kebort Manufacturing Corporation has a traditional

Q11: (Appendix 4A)Koszyk Manufacturing Corporation has a traditional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents