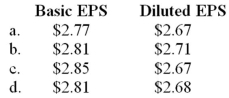

Ignatius Corporation had 7 million shares of common stock outstanding during the current calendar year. It issued ten thousand $1,000, convertible bonds on January 1. Each bond is convertible into 50 shares of common stock. The bonds were issued at face amount and pay interest quarterly at an annual rate of 10%. On June 30, Ignatius issued 100,000 shares of $100 par 6% cumulative preferred stock. Dividends are declared and paid semiannually. Ignatius has an effective tax rate of 40%. Ignatius would report the following EPS data (rounded) on its net income of $20 million:

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Q95: Preferred dividends would not be subtracted from

Q100: At December 31, 2013, Hansen Corporation had

Q101: During the current year, High Corporation had

Q103: Red Company is a calendar-year U.S. firm

Q105: Which of the following statements is true

Q106: Green Company is a calendar-year U.S. firm

Q107: During the current year, East Corporation had

Q108: When a company's income statement includes discontinued

Q109: Basic and diluted earnings per share data

Q138: Under IFRS, a deferred tax asset for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents