In its 2013 annual report to shareholders, Marianne James Companies Inc. (MJCI) disclosed the following information regarding its postemployment benefit plans:

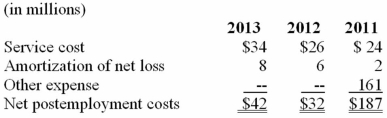

The Company and certain of its affiliates sponsor postemployment benefit plans covering substantially all salaried and certain hourly employees. The cost of these plans is charged to expense over the working life of the covered employees. Net postemployment costs consisted of the following for the years ended December 31, 2013, 2012, and 2011:  The company instituted workforce reduction programs in its North American food operations in 2011. These actions resulted in incremental postemployment costs, which are shown as other expense above.

The company instituted workforce reduction programs in its North American food operations in 2011. These actions resulted in incremental postemployment costs, which are shown as other expense above.

Required:

Describe the three components in the net postemployment costs disclosed by MJCI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q179: Data pertaining to the postretirement health care

Q180: On January 1, 2013, Tom's Transport Company's

Q181: DeAngelo Yards, Inc., calculated pension expense for

Q187: What are the possible components of pension

Q188: An increase in the assumed rate of

Q222: In its 2018 annual report to

Q223: Pension plans typically require some minimum period

Q231: In its 2018 annual report to

Q240: Discuss the accounting for postretirement benefits prior

Q244: How do U.S. GAAP and IFRS differ

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents