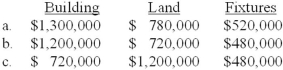

Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum price of $2,400,000. The building was completely furnished. According to independent appraisals, the fair values were $1,300,000, $780,000, and $520,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be:

A) Option a

B) Option b

C) Option c

D) None of the above.

Correct Answer:

Verified

Q27: Holiday Laboratories purchased a high-speed industrial centrifuge

Q31: Use the following to answer questions

Montana Mining

Q35: Which of the following does not pertain

Q38: Cantor Corporation acquired a manufacturing facility on

Q39: When selling property, plant, and equipment for

Q41: Interest is eligible to be capitalized as

Q41: In Case B,Grand Forks would record a

Q42: In Case B, Pensacola would record a

Q45: The balance sheets of Davidson Corporation reported

Q73: Interest is not capitalized for:

A) Assets that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents