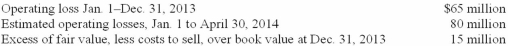

On November 1, 2013, Jamison Inc. adopted a plan to discontinue its barge division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by April 30, 2014. On December 31, 2013, the company's year-end, the following information relative to the discontinued division was accumulated:  In its income statement for the year ended December 31, 2013, Jamison would report a before-tax loss on discontinued operations of:

In its income statement for the year ended December 31, 2013, Jamison would report a before-tax loss on discontinued operations of:

A) $65 million.

B) $50 million.

C) $130 million.

D) $145 million.

Correct Answer:

Verified

Q16: Comprehensive income is the total change in

Q16: Provincial Inc. reported the following before-tax income

Q17: Popson Inc. incurred a material loss that

Q18: International Financial Reporting Standards require a company

Q20: The definition of what constitutes an extraordinary

Q22: Suppose that the Footwear Division's assets had

Q23: Howard Co.'s 2013 income from continuing operations

Q24: Cendant Corporation's results for the year ended

Q25: What is Misty's income before extraordinary item(s)?

A)$198.

B)$210.

C)$330.

D)$360.

Q26: On August 1, 2013, Rocket Retailers adopted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents