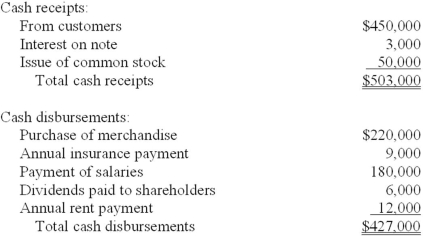

Raintree Corporation maintains its records on a cash basis. At the end of each year the company's accountant obtains the necessary information to prepare accrual basis financial statements. The following cash flows occurred during the year ended December 31, 2013:  Selected balance sheet information:

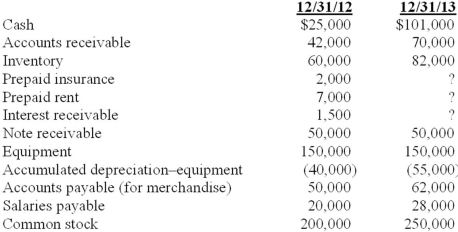

Selected balance sheet information:  Additional information:

Additional information:

1. On June 30, 2012, Raintree lent a customer $50,000. Interest at 6% is payable annually on each June 30. Principal is due in 2016.

2. The annual insurance payment is made in advance on March 31.

3. Annual rent on the company's facilities is paid in advance on September 30.

Required:

1. Prepare an accrual basis income statement for 2013 (ignore income taxes).

2. Determine the following balance sheet amounts on December 31, 2013:

a. Interest receivable

b. Prepaid insurance

c. Prepaid rent

Correct Answer:

Verified

Q102: Prepare a classified balance sheet for China

Q103: Prepare the closing entries for China Tea

Q104: Kline's 2013 net income (or loss):

Q105: Presented below is income statement information of

Q106: Describe what is meant by unearned revenues

Q108: The following is selected financial information for

Q109: Based on the information presented above, prepare

Q110: Prepare an income statement for China Tea

Q111: Describe the difference between external events and

Q112: Kline's 12/31/13 total shareholders' equity:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents