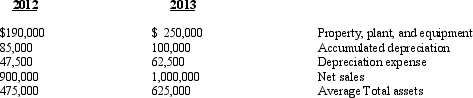

Cripple Creek Inc. Use the information presented below for Cripple Creek,Inc.for 2013 and 2012 to answer the questions that follow.Cripple Creek uses the straight-line depreciation method. Refer to the information for Cripple Creek,Inc.

Refer to the information for Cripple Creek,Inc.

Between 2012 and 2013,Cripple Creek sold some equipment that had an original cost of $57,500.Which statement is most likely true concerning transactions that must have occurred during the period?

A) Cripple Creek also purchased additional equipment during the year.

B) The selling price of the equipment sold was reported with net sales.

C) The equipment that was sold had a book value of $12,500.

D) The equipment sold had not been reported with Cripple Creek's property,plant and equipment.

Correct Answer:

Verified

Q1: The Property,Plant,and Equipment category includes long-term investments.

Q13: On the balance sheet,a company reports plant

Q83: At the end of 2013, Mirror Productions

Q84: At the end of 2013,Clock Products,Inc.determined that

Q84: Waxman Company purchased a patent for $170,000

Q87: Cripple Creek Inc. Use the information presented

Q96: Ramirez Stores purchased a trademark at the

Q121: All of the following statements are true

Q122: The income statement of Hope Market, Inc.reported

Q128: Which of the following items is added

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents