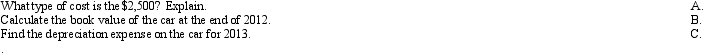

Glidewell Company purchased a car for a salesman for $23,500 at the beginning of 2012.The car had an estimated life of 5 years,and an estimated residual value of $3,500.Glidewell used the straight-line depreciation method.At the beginning of 2013,Glidewell incurred $2,500 to replace the car's transmission.This resulted in a 2-year extension of the car's useful life,but no change in the residual value.

Correct Answer:

Verified

Q143: A change in estimate should be recorded

Q145: The two items that must be estimated

Q150: Stately Co.began construction of a new factory

Q151: For each of the following sentences 11-14,select

Q153: Captain Lewis,Inc.purchased equipment at the beginning of

Q157: For each of the following sentences 11-14,select

Q158: Given below are several accounts and balances

Q159: On January 1,2014,Aaron Simpson bought a farm

Q160: Please answer the following questions regarding depreciation:

_

Q171: Why do many companies use MACRS Modified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents