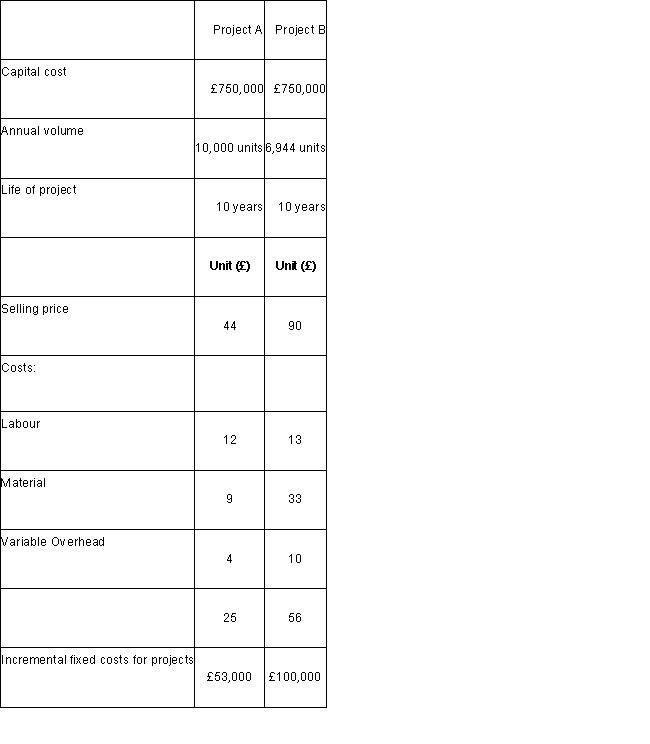

Greenwich plc is considering adding two new products at a subsidiary to improve its overall competitiveness. The new products are enthusiastically supported by the managers responsible and an immediate decision is required. It is normal for the managers to calculate the net present value (NPV) for the projects before it is accepted or rejected.

Details of the proposals

-

Calculate the Net Present Value of the cash flows for Project A

A) £13,200.

B) £25,200.

C) £28,942.

D) £18,942.

Correct Answer:

Verified

Q7: What is the expected value of

Q8: The payback capital budgeting technique considers

Q9: (Appendix 14D) The release of working capital

Q10: The present value of a given sum

Q12: Which of the following capital budgeting

Q13: The calculation of the net present value

Q13: If an investment has cash outflows of

Q14: The required rate of return is the

Q15: (Ignore income taxes in this problem.) Allen

Q16: Greenwich plc is considering adding two new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents