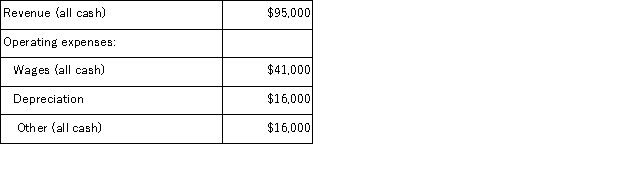

The Halsey Corporation is contemplating the purchase of new equipment that would require an initial investment of $125,000.The equipment would have a useful life of six years,with a salvage value of $29,000.This new equipment would be depreciated over its useful life by the straight-line method.It would replace existing equipment which is fully depreciated.The existing equipment has a salvage value now of $38,000.The anticipated annual revenues and expenses associated with the new equipment are:  Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. The payback period is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. The payback period is closest to:

A) 5.7 years

B) 4.0 years

C) 2.3 years

D) 1.8 years

Correct Answer:

Verified

Q62: An expansion at Fidell, Inc., would increase

Q63: The management of Duker Corporation is investigating

Q66: Mercer Corporation is considering replacing a technologically

Q68: The management of Stanforth Corporation is investigating

Q72: Baldock Inc.is considering the acquisition of a

Q78: Carlson Manufacturing has some equipment that needs

Q79: Chee Corporation has gathered the following data

Q80: Pro-Mate,Inc.is a producer of athletic equipment.The company

Q84: Clairmont Corporation is considering the purchase of

Q97: Betterway Pharmacy has purchased a small auto

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents