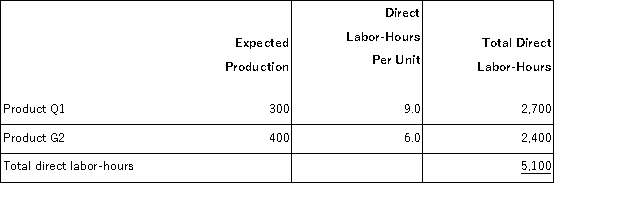

Rosman,Inc. ,manufactures and sells two products: Product Q1 and Product G2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $23.80 per DLH.The direct materials cost per unit for each product is given below:

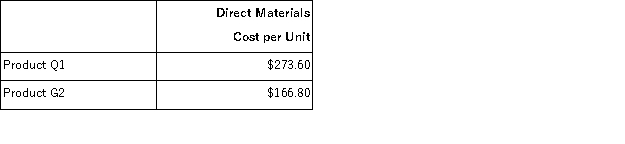

The direct labor rate is $23.80 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

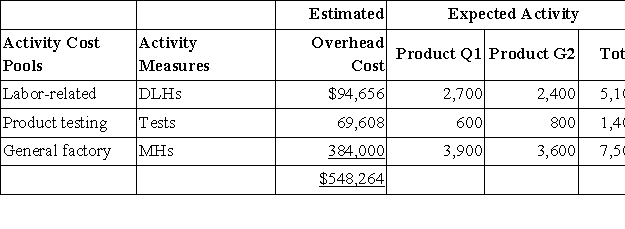

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

Required:

What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q177: Mellencamp,Inc. ,manufactures and sells two products: Product

Q178: Mellencamp,Inc. ,manufactures and sells two products: Product

Q179: Swimm Company allocates materials handling cost to

Q180: Sampaga,Inc. ,manufactures and sells two products: Product

Q181: Swagg Jewelry Corporation manufactures custom jewelry.In the

Q183: Nakayama,Inc. ,manufactures and sells two products: Product

Q184: Vivino,Inc. ,manufactures and sells two products: Product

Q185: Din,Inc. ,manufactures and sells two products: Product

Q186: Gribbins,Inc. ,manufactures and sells two products: Product

Q187: Besser,Inc. ,manufactures and sells two products: Product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents