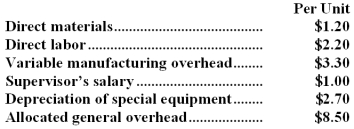

Part I51 is used in one of Pries Corporation's products.The company makes 18,000 units of this part each year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $15.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $26,000 of these allocated general overhead costs would be avoided. If management decides to buy part I51 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to produce this part and sell it to the company for $15.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $26,000 of these allocated general overhead costs would be avoided. If management decides to buy part I51 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

A) Net operating income would decline by $81,800 per year.

B) Net operating income would decline by $55,800 per year.

C) Net operating income would decline by $119,800 per year.

D) Net operating income would decline by $29,800 per year.

Correct Answer:

Verified

Q17: Vertical integration is the involvement by a

Q18: A sunk cost is a cost that

Q19: Generally,a product line should be dropped when

Q20: An avoidable cost is a cost that

Q21: Product R19N has been considered a drag

Q23: Which of the following are valid reasons

Q24: Power Systems Inc.manufactures jet engines for the

Q25: A study has been conducted to determine

Q26: The Kelsh Company has two divisions--North and

Q27: Stampka Corporation is a specialty component manufacturer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents