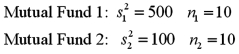

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

A) No,because the value of the test statistic is less than the critical F value.

B) Yes,because the value of the test statistic is less than the critical F value.

C) Yes,because the value of the test statistic is greater than the critical F value.

D) No,because the value of the test statistic is greater than the critical F value.

Correct Answer:

Verified

Q68: Exhibit 11-6.A financial analyst examines the performance

Q69: A random sample of 10 homes sold

Q70: The sample standard deviation of the monthly

Q71: Exhibit 11-5.Amie Jackson,a manager at Sigma travel

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents