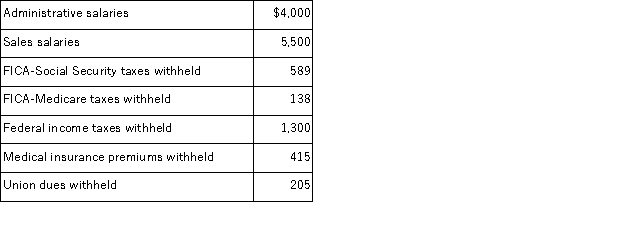

A company's payroll information for the month of May follows:  On May 31 the company issued Check No. 4625 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check.

On May 31 the company issued Check No. 4625 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check.

(1) Prepare the journal entry to record (accrue) the employer's payroll for May. (2) Prepare the journal entry to record payment of the May payroll. The federal and state unemployment tax rates are 0.6% and 5.4%, respectively, on the first $7,000 paid to each employee. The wages and salaries subject to these taxes were $6,000. (3) Prepare the journal entry to record the employer's payroll taxes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: An employer has an employee benefit package

Q161: A company borrowed $60,000 by signing a

Q186: The payroll records of a company provided

Q187: A company's employer payroll tax rates are

Q189: The payroll record of a company provided

Q190: A company's payroll for the week ended

Q192: A company has 90 employees and a

Q194: Santa Barbara Express has 4 sales employees,

Q195: A company sells tablet computers for $1,300

Q196: On January 31, Ransom Company's payroll register

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents