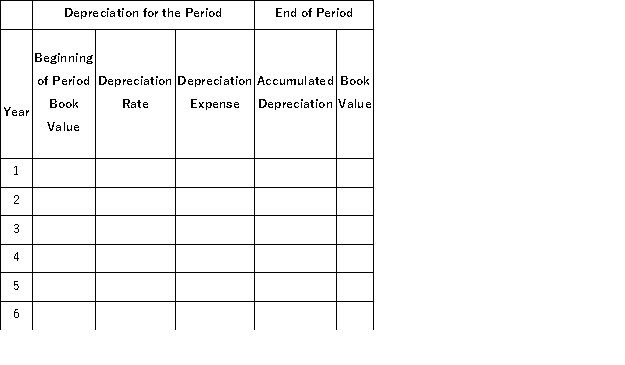

On September 30 of the current year, a company acquired and placed in service a machine at a cost of $700,000. It has been estimated that the machine has a service life of five years and a salvage value of $40,000. Using the double-declining-balance method of depreciation, complete the schedule below showing depreciation amounts for all six years (round answers to the nearest dollar). The company closes its books on December 31 of each year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Riverboat Adventures pays $310,000 plus $15,000 in

Q95: Phoenix Agency leases office space for $7,000

Q106: Greene Company purchased a machine for $75,000

Q181: A company purchased and installed equipment on

Q183: The Oberon Company purchased a delivery truck

Q185: A company purchased and installed equipment on

Q186: A company's property records revealed the following

Q190: Explain the difference between revenue expenditures and

Q193: Compare the different depreciation methods (straight-line, units-of-production,

Q198: On April 1 of the current year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents