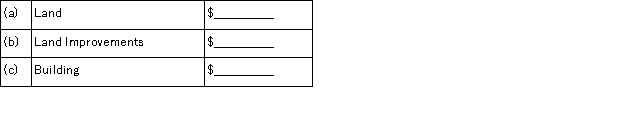

A company paid $595,000 for property that included land appraised at $384,000; land improvements appraised at $128,000; and a building appraised at $288,000. The plan is to use the building as a manufacturing plant. Determine the amounts that should be recorded as:

Correct Answer:

Verified

Q111: On April 1,Year 5 a company discarded

Q112: On January 2,2010,a company purchased a delivery

Q113: On January 1,2016,a company disposed of equipment

Q126: A company purchased land with a building

Q212: A company purchased and installed machinery on

Q215: A company had net sales of $230,000

Q216: Suarez Company uses the straight-line method of

Q216: A company purchased a special purpose machine

Q217: A company purchased land on which to

Q219: A company purchased a machine on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents