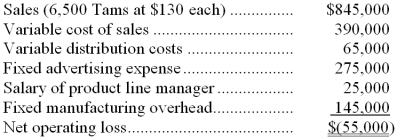

The Clemson Company reported the following results last year for the manufacture and sale of one of its products known as a Tam.  Clemson Company is trying to determine whether or not to discontinue the manufacture and sale of Tams. The operating results reported above for last year are expected to continue in the foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the costs of production facilities and equipment that the Tam product shares with other products produced by Clemson. If the Tax product were dropped, there would be no change in the fixed manufacturing costs of the company.

Clemson Company is trying to determine whether or not to discontinue the manufacture and sale of Tams. The operating results reported above for last year are expected to continue in the foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the costs of production facilities and equipment that the Tam product shares with other products produced by Clemson. If the Tax product were dropped, there would be no change in the fixed manufacturing costs of the company.

-Assume that discontinuing the Tam product would result in a $120,000 increase in the contribution margin of other product lines. How many Tams would have to be sold next year for the company to be as well off as if it just dropped the line and enjoyed the increase in contribution margin from other products?

A) 5,000 units

B) 6,000 units

C) 6,500 units

D) 7,000 units

Correct Answer:

Verified

Q58: An automated turning machine is the current

Q59: Badal Corporation processes sugar beets in batches.

Q60: Arline Cane Products, Inc., processes sugar cane

Q61: Mccubbin Corporation is considering two alternatives: A

Q62: Rowena Corporation manufactures laser printers. Rowena currently

Q64: Libbee Corporation is presently making part I50

Q65: Libbee Corporation is presently making part I50

Q66: Two alternatives, code-named X and Y, are

Q67: The Tolar Company has 400 obsolete desk

Q68: The management of Zorrilla Corporation is considering

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents