Weltin Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow:

Sales are budgeted at $390,000 for November, $370,000 for December, and $380,000 for January.

Collections are expected to be 90% in the month of sale, 5% in the month following the sale, and 5% uncollectible.

The cost of goods sold is 60% of sales.

The company purchases 70% of its merchandise in the month prior to the month of sale and 30% in the month of sale. Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $21,800.

Monthly depreciation is $18,000.

Ignore taxes.

Required:

a. Prepare a Schedule of Expected Cash Collections for November and December.

b. Prepare a Merchandise Purchases Budget for November and December.

c. Prepare Cash Budgets for November and December.

d. Prepare Budgeted Income Statements for November and December.

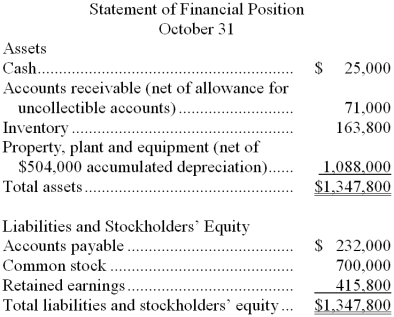

e. Prepare a Budgeted Balance Sheet for the end of December.

Correct Answer:

Verified

Q134: TabComp Inc. is a retail distributor for

Q135: Gokey Inc. bases its manufacturing overhead budget

Q136: Carner Lumber sells lumber and general

Q137: Glinski Corporation is working on its direct

Q138: Carner Lumber sells lumber and general

Q140: Carner Lumber sells lumber and general

Q141: Borling Inc. bases its selling and administrative

Q142: The selling and administrative expense budget of

Q143: Payment Inc. is preparing its cash budget

Q144: Matuseski Corporation is preparing its cash budget

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents