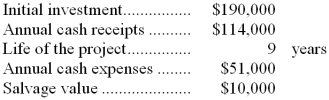

Littau Inc. has provided the following data concerning an investment project that has been proposed:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

-When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A) $0

B) $3,000

C) $10,000

D) $7,000

Correct Answer:

Verified

Q19: Suppose a machine that costs $80,000 has

Q20: Brownell Inc. currently has annual cash revenues

Q21: Demirjian Inc. is considering an investment project

Q22: Wable Inc. has provided the following data

Q23: Wable Inc. has provided the following data

Q25: Demirjian Inc. is considering an investment project

Q26: Wable Inc. has provided the following data

Q27: Management is considering purchasing an asset for

Q28: Wable Inc. has provided the following data

Q29: Salomone Inc. has provided the following data

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents