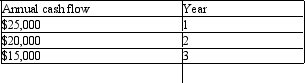

Mac Products Inc. is considering the purchase of a new machine. The estimated cost of the machine is $30,000. The machine is expected to generate annual cash inflows over the next three years as follows:  The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

A) $8,965.

B) $24,056.

C) $12,338.

D) $840.

Correct Answer:

Verified

Q56: NC Products Inc. is considering investing in

Q57: RicChallengingson Corporation has the following information available

Q58: Peterson Inc. has the following information available

Q59: Assuming taxes are a consideration, which of

Q60: Morris Manufacturing is in the 25 percent

Q62: Buchanan Enterprises is considering investing in a

Q63: Hazir Products accepts capital investment projects with

Q64: Clinton Inc. is considering the purchase of

Q65: Putter Inc. requires all capital investment projects

Q66: What is the difference between the discount

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents