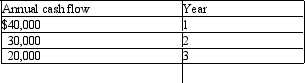

Meredith Products Inc. is considering a new equipment purchase. The estimated cost of the equipment is $80,000. The equipment is expected to generate annual operating cash inflows for the next three years as follows:

The equipment is expected to have a salvage value at the end of its useful life of $15,000. The company uses a discount rate of 14%.

The equipment is expected to have a salvage value at the end of its useful life of $15,000. The company uses a discount rate of 14%.

Required: Compute the net present value of the equipment. (Ignore income taxes)

Correct Answer:

Verified

Q76: Why do capital investment decisions require consideration

Q77: Chester Manufacturing is considering a project that

Q78: Vinson Manufacturing requires all capital investment projects

Q79: Grant Manufacturing is considering investing in equipment

Q80: Tyson Enterprises is considering investing in a

Q82: Vincent Products is considering a project that

Q83: A local merchant is considering the purchase

Q84: A local company requires all capital investments

Q85: Fill in the blank with either the

Q86: Blue Fin Inc. requires all capital investments

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents