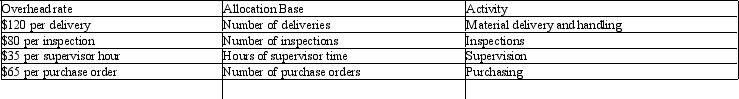

Jones Construction currently uses traditional costing where overhead is applied based on direct labor hours. Using traditional costing, the applied overhead rate is $24 per direct labor hour. They are considering a switch to activity-based costing (ABC) . The company controller has come up with preliminary overhead rates for each of the following activities: One of the company's current jobs has the following information available:

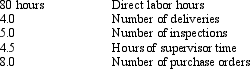

One of the company's current jobs has the following information available: Which of the following statements is true when comparing the total overhead allocated to the job using traditional versus ABC costing?

Which of the following statements is true when comparing the total overhead allocated to the job using traditional versus ABC costing?

A) ABC costing will yield $362.50 less in overhead cost being allocated to the job.

B) ABC costing will yield $725.50 less in overhead cost being allocated to the job.

C) ABC costing will yield $345.50 more in overhead cost being allocated to the job.

D) ABC costing will yield $725.50 more in overhead cost being allocated to the job.

Correct Answer:

Verified

Q53: Which of the following is false regarding

Q54: Compton Corporation The following overhead cost information

Q55: Activity-based costing (ABC):

A) should not be applied

Q56: Which of the following statements regarding service

Q57: Aunt Lucy's Candies Aunt Lucy's Candies sells

Q59: Which of the following types of costs

Q60: Which of the following types of companies

Q61: Mountaineer Tents manufactures and sells heavy and

Q62: For each of the following activities, identify

Q63: The following overhead cost information is available

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents