Assume that on September 1, 2016, a 6-month rent payment for $12,000 per month (for a total of $72,000) was made with respect to a commercial lease that the company entered into on that date as a tenant. The company took occupancy of the rented space immediately. The lease term will expire on February 28, 2017. The $72,000 payment was recorded as a debit to Prepaid Rent on September 1, 2016. The adjusting entry on December 31, 2016, is as follows:

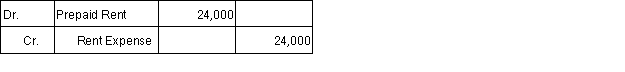

A)

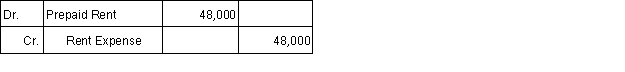

B)

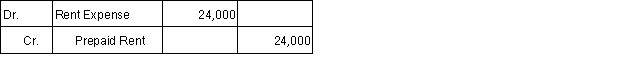

C)

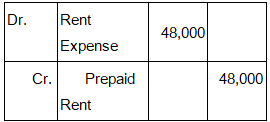

D)

Correct Answer:

Verified

Q44: Prepare a bank reconciliation for Grace, Inc.,

Q46: On January 1, 2017, the balance in

Q47: The following is a portion of the

Q48: The following are data available for Blue

Q51: Agrico, Inc., accepted a 6-month, 9% (annual

Q52: Which of the following is NOT an

Q53: Prepare a bank reconciliation for Show Me,

Q54: The following are data available for Richards

Q57: At the beginning of the year, accounts

Q61: a.If the beginning balance of the Inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents