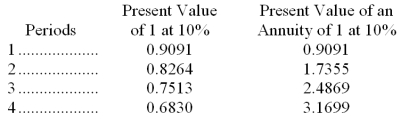

Edgar Company is considering the purchase of new equipment costing $80,000. The projected net cash flows are $35,000 for the first two years and $30,000 for years three and four. The revenue is to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Edgar requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity for different periods is presented below. Compute the net present value of the machine.

A) $(15,731) .

B) $(4,896) .

C) $15,731.

D) $4,896.

E) $23,775.

Correct Answer:

Verified

Q83: A new manufacturing machine is expected to

Q85: Axle Company can produce a product that

Q96: A company is considering the purchase of

Q99: Saxon Manufacturing is considering purchasing two machines.

Q101: A company puts four products through a

Q102: Jorgensen Department Store has three departments: Clothing,

Q104: Bower Co. is reviewing a capital investment

Q105: A company has just received a special,

Q129: Briefly describe the time value of money.

Q160: How does the calculation of break-even time

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents