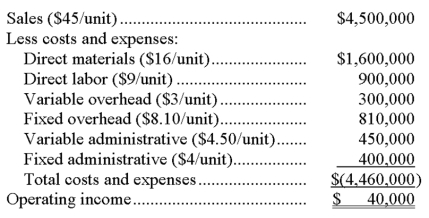

Peters, Inc. sells a single product and reports the following results from sales of 100,000 units:  A foreign company wants to purchase 15,000 units. However, they are willing to pay only $36 per unit for this one-time order. They also agree to pay all freight costs. To fill the order, Peters will incur normal production costs. Total fixed overhead will have to be increased by $60,000 to pay for equipment rentals and insurance. No additional administrative costs (variable or fixed) will be incurred in association with this special order.

A foreign company wants to purchase 15,000 units. However, they are willing to pay only $36 per unit for this one-time order. They also agree to pay all freight costs. To fill the order, Peters will incur normal production costs. Total fixed overhead will have to be increased by $60,000 to pay for equipment rentals and insurance. No additional administrative costs (variable or fixed) will be incurred in association with this special order.

Required:

(1) Should Peters accept the order if it does not affect regular sales? Explain.

(2) Assume that Peters can accept the special order only by giving up 5,000 units of its normal sales. Should Peters accept the special order under these circumstances?

Correct Answer:

Verified

Q107: You have evaluated three projects using the

Q110: A company inadvertently produced 6,000 defective portable

Q112: Fleming Company had the following results of

Q119: For each of the capital budgeting methods

Q122: Good management accounting indicates that projects be

Q124: A company is considering purchasing a machine

Q146: Identify at least three reasons for managers

Q150: A company must decide between scrapping or

Q154: A company manufactures two products. Each unit

Q155: What is one advantage and one disadvantage

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents