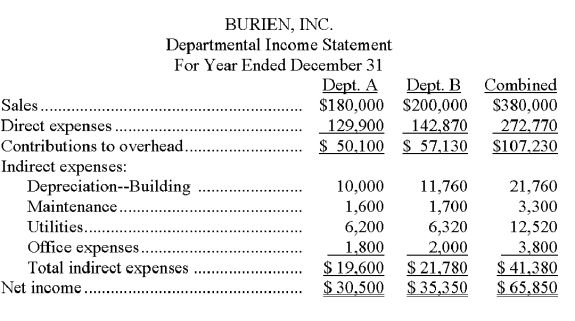

Burien, Inc., operates a retail store with two departments, A and

B. Its departmental income statement for the current year follows:

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

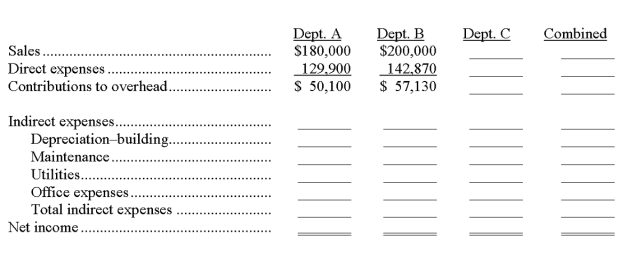

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

Correct Answer:

Verified

Q121: A company produces two joint products (called

Q131: What is the primary purpose for using

Q133: Describe the two-stage allocation of overhead costs.

Q136: A retail store has three departments, A,

Q137: List the steps required to prepare a

Q142: Outdoor Sports, Inc., produces two types of

Q143: Keegan Co. has four departments: purchasing, human

Q146: Vaughn Co. operates three separate departments (A,

Q164: Samm's Department Store operates three departments (A,

Q193: A_ accumulates and reports costs and expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents