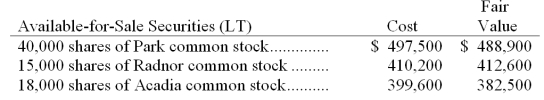

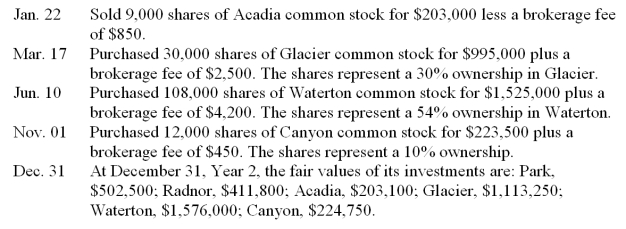

Eaton Company had the following long-term available-for-sale securities in its portfolio at December 31, Year 1. Eaton had several long-term investment transactions during the next year. After analyzing the effects of each transaction, (1) determine the amount Eaton should report on its December 31, Year 1 balance sheet for its long-term investments in available-for-sale securities, (2) determine the amount Eaton should report on its December 31, Year 2 balance sheet for its long-term investments in available-for-sale securities, (3) prepare the necessary adjusting entry to record the fair value adjustment at December 31, Year 2.

Correct Answer:

Verified

Q140: Detalo Co.held bonds of Schooner Corp.with a

Q146: On October 31,Mayfair Co.received cash dividends of

Q151: Savan Co.purchased 14,000 shares of Briton Corporation's

Q166: Golden Age Co. exports Native American artwork

Q171: Texana Inc. imports inventory from Mexico. Prepare

Q172: Mian sells American gourmet foods to merchandisers

Q173: Kramer Corporation had the following long-term investment

Q174: Acadia had no investments prior to the

Q204: _ are investments in securities that are

Q206: Short-term investments in held-to-maturity debt securities are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents