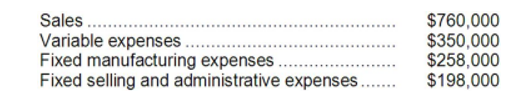

The management of Cackowski Corporation has been concerned for some time with the financial performance of its product I11S and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $185,000 of the fixed manufacturing expenses and $132,000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued.

-What would be the effect on the company's overall net operating income if product I11S were dropped?

A) Overall net operating income would decrease by $46,000.

B) Overall net operating income would increase by $93,000.

C) Overall net operating income would increase by $46,000.

D) Overall net operating income would decrease by $93,000.

Correct Answer:

Verified

Q114: Rama Corporation is presently making part J56

Q115: Hadley, Inc. makes a line of bathroom

Q116: Dockwiller Inc. manufactures industrial components. One of

Q117: An outside supplier has offered to sell

Q118: Hermenegildo Corporation is presently making part P42

Q120: Rama Corporation is presently making part J56

Q121: The Madison Corporation produces three products with

Q123: The constraint at Bonavita Corporation is time

Q124: Crane Corporation makes four products in a

Q141: Cranston Corporation makes four products in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents