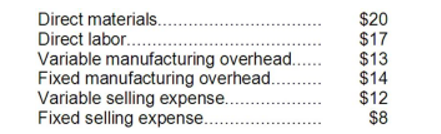

The Melrose Corporation produces a single product, Product C. Melrose has the capacity to produce 70,000 units of Product C each year. If Melrose produces at capacity, the per unit costs to produce and sell one unit of Product C are as follows:

The regular selling price of one unit of Product C is $100. A special order has been received by Melrose from Moore Corporation to purchase 7,000 units of Product C during the upcoming year. If this special order is accepted, the variable selling expense will be reduced by 75%. Total fixed manufacturing overhead and fixed selling expenses would be unaffected except that Melrose will need to purchase a specialized machine to engrave the Moore name on each unit of product C in the special order. The machine will cost $10,500 and will have no use after the special order is filled. Assume that direct labor is a variable cost.

-Suppose Melrose can sell 68,000 units of Product C to regular customers next year. If Moore Corporation offers to buy the special order units at $90 per unit, the effect of accepting the special order for 7,000 units on Melrose's net operating income for next year will be a:

A) $79,500 increase

B) $104,000 increase

C) $114,500 increase

D) $294,000 increase

Correct Answer:

Verified

Q131: Brown Corporation makes four products in a

Q132: The following are the Jensen Corporation's unit

Q134: The constraint at Bonavita Corporation is time

Q136: The Madison Corporation produces three products with

Q137: The following are the Jensen Corporation's unit

Q138: Brown Corporation makes four products in a

Q139: The Madison Corporation produces three products with

Q140: The Madison Corporation produces three products with

Q149: Bruce Corporation makes four products in a

Q155: Cranston Corporation makes four products in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents