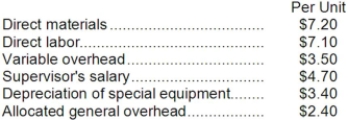

Kerbow Corporation uses part B76 in one of its products. The company's Accounting Department reports the following costs of producing the 12,000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $27.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $6,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce part B76 could be used to make more of one of the company's other products, generating an additional segment margin of $29,000 per year for that product.

An outside supplier has offered to make the part and sell it to the company for $27.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $6,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce part B76 could be used to make more of one of the company's other products, generating an additional segment margin of $29,000 per year for that product.

Required:

a. Prepare a report that shows the effect on the company's total net operating income of buying part B76 from the supplier rather than continuing to make it inside the company.

b. Which alternative should the company choose?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q168: Adamyan Co. manufactures and sells medals for

Q169: Holt Company makes three products in a

Q170: Glocker Company makes three products in a

Q171: Foster Company makes 20,000 units per year

Q172: The most recent monthly income statement for

Q174: Part O43 is used in one of

Q175: Bulan Inc. makes a range of products.

Q176: Globe Manufacturing Company has just obtained a

Q177: Juett Company produces a single product. The

Q178: A customer has asked Goes Corporation to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents