Mitchener Corp. manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $300,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

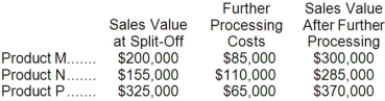

Each product may be sold at the split-off point or processed further. The additional processing costs and sales value after further processing for each product (on an annual basis) are:  Required:

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q175: Bulan Inc. makes a range of products.

Q176: Globe Manufacturing Company has just obtained a

Q177: Juett Company produces a single product. The

Q178: A customer has asked Goes Corporation to

Q179: Albertine Co. manufactures and sells trophies for

Q180: Falsetta Corporation makes three products that use

Q181: Lafoe Corporation produces two intermediate products, A

Q183: Bowdish Corporation purchases potatoes from farmers. The

Q184: Benjamin Signal Company produces products R, J,

Q185: Iaci Company makes two products from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents