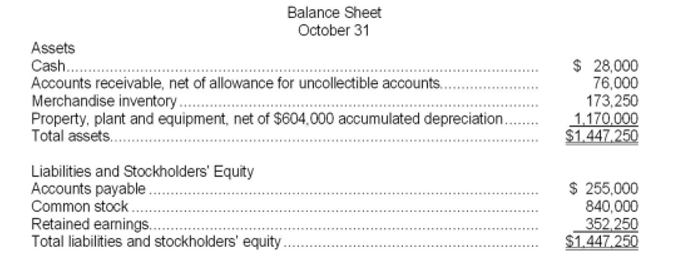

Bracken Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:

• Sales are budgeted at $330,000 for November, $340,000 for December, and $340,000 for January.

• Collections are expected to be 80% in the month of sale, 17% in the month following the sale, and 3% uncollectible.

• The cost of goods sold is 75% of sales.

• The company would like to maintain ending merchandise inventories equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $21,800.

• Monthly depreciation is $19,000.

• Ignore taxes.

-The cost of December merchandise purchases would be:

A) $225,000

B) $178,500

C) $247,500

D) $255,000

Correct Answer:

Verified

Q87: Bracken Corporation is a small wholesaler of

Q88: Harris, Inc., has budgeted sales in units

Q89: Bracken Corporation is a small wholesaler of

Q90: The following are budgeted data for the

Q91: Dilbert Farm Supply is located in a

Q93: Dilbert Farm Supply is located in a

Q94: Dilbert Farm Supply is located in a

Q95: The following are budgeted data for the

Q96: The following are budgeted data for the

Q97: Dilbert Farm Supply is located in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents