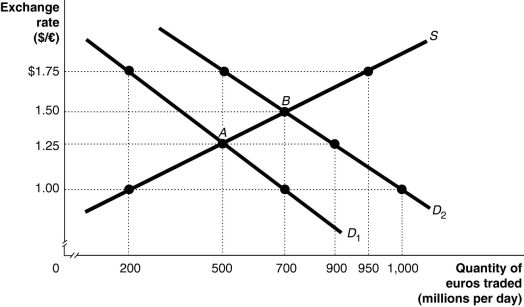

Figure 30-8

-Refer to Figure 30-8.The equilibrium exchange rate is originally at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D2.If the European Central Bank abandons the peg,the equilibrium exchange rate would be

A) $1.00/euro.

B) $1.25/euro.

C) $1.50/euro.

D) $1.75/euro.

Correct Answer:

Verified

Q141: A currency pegged at a value above

Q144: Figure 30-8 Q145: The Bulgarian currency,the lev,is pegged to the Q146: Compared to a situation in which there Q150: The year in which euro coins and Q154: Fluctuating exchange rates can alter a multinational Q156: If a country sets a pegged exchange Q158: Pegging a country's exchange rate to the Q160: You decide to work in London for Q163: Firms in Thailand that had _ while![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents