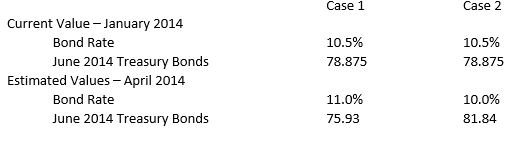

In late January 2014, The Union Cosmos Company is considering the sale of €100 million in 10-year debentures that will probably be rated AAA like the firm's other bond issues. The firm is anxious to proceed at today's rate of 10.5 per cent. As treasurer, you know that it will take until sometime in April to get the issue registered and sold. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts each representing €100,000.  Explain how you would go about hedging the bond issue?

Explain how you would go about hedging the bond issue?

A) Sell 1000 contracts

B) Buy 1000 contracts

C) Sell 100 contracts

D) Sell 10 000 contracts

E) None of the above

Correct Answer:

Verified

Q1: The bond that maximises the difference between

Q2: As a relationship officer for a money-centre

Q4: Refer to the previous question. What is

Q5: The process by which invest on margin

Q6: According to the cost of carry model

Q9: Refer to the previous question. What is

Q10: Which of the following is true when

Q11: Refer to the previous two questions. What

Q32: The major difference between valuing futures versus

Q52: In your portfolio you have $1 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents