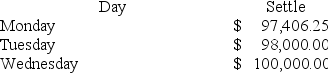

On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer the following questions.

On which of the given days do you get a margin call?

A) Monday

B) Tuesday

C) Wednesday

D) none of these options

Correct Answer:

Verified

Q62: A hypothetical futures contract on a nondividend-paying

Q63: At contract maturity the basis should equal

Q64: A 1-year gold futures contract is selling

Q65: The swap market is a huge component

Q66: The use of leverage is practiced in

Q68: Interest rate swaps involve the exchange of

Q69: Sahali Trading Company has issued $100 million

Q70: You believe that the spread between the

Q71: On Monday morning you sell one June

Q72: The _ contract dominates trading in stock-index

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents