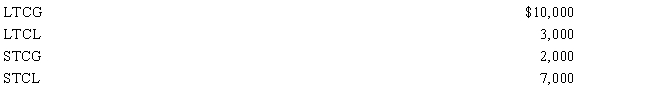

During 2016, Addison has the following gains and losses:

a.How much is Addison's tax liability if she is in the 15% tax bracket?

b.If her tax bracket is 33% (not 15%)?

Correct Answer:

Verified

Q88: Harold bought land from Jewel for $150,000.Harold

Q89: On January 1,2006,Cardinal Corporation issued 5% 25-year

Q96: During 2016, Jackson had the following capital

Q97: For the current year, David has wages

Q105: On January 1,2016,Faye gave Todd,her son,a 36-month

Q111: In January 2016,Tammy purchased a bond due

Q112: Ted was shopping for a new automobile.

Q113: Rachel, who is in the 35% marginal

Q114: Katherine is 60 years old and is

Q123: Rachel owns rental properties. When Rachel rents

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents