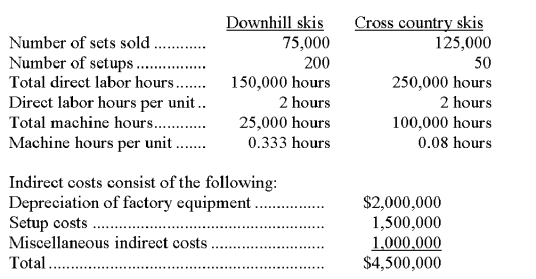

Outdoor Sports, Inc., produces two types of skis, downhill skis and cross country skis. Product and production information about the two items is shown below:

Required:

1. If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Outdoor Sports uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q139: Define an investment center. How are investment

Q141: Texas Toys, a retail store, has four

Q142: Scottie is the manager of an investment

Q144: A _ incurs costs and generates revenues.

Q145: The following data is available for the

Q146: Renton Co. has two operating (production) departments

Q147: Larabee Company produces two types of product,

Q148: Keegan Co. has four departments: purchasing, human

Q166: What is the main difference between a

Q168: Define joint costs and explain how joint

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents