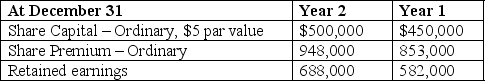

Beewell's net income for the year ended December 31, Year 2 was $185,000. Information from Beewell's comparative balance sheets is given below. Compute the cash received from the sale of its ordinary shares during Year 2.

A) $185,000.

B) $106,000.

C) $95,000.

D) $50,000.

E) $145,000.

Correct Answer:

Verified

Q106: In preparing a company's statement of cash

Q107: Trenton reports tax-exempt income of $230,000 for

Q108: Sebring Company reports depreciation expense of $40,000

Q109: Which of the following transactions or events

Q110: Beewell's net income for the year ended

Q112: Weston is preparing the company's statement of

Q113: Sebring Company reports depreciation expense of $40,000

Q114: Analysis reveals that a company had a

Q115: Stojko Corporation had a net decrease in

Q116: Use the following information to calculate cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents