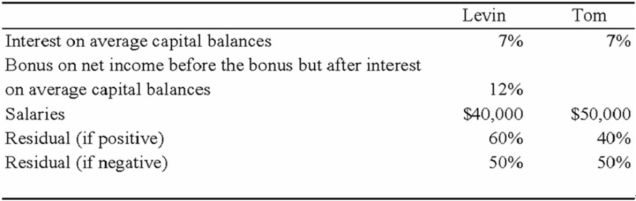

Net income for Levin-Tom partnership for 2009 was $125,000. Levin and Tom have agreed to distribute partnership net income according to the following plan:  Additional Information for 2009 follows:

Additional Information for 2009 follows:

1. Levin began the year with a capital balance of $75,000.

2. Tom began the year with a capital balance of $100,000.

3. On March 1, Levin invested an additional $25,000 into the partnership.

4. On October 1, Tom invested an additional $20,000 into the partnership.

5. Throughout 2009, each partner withdrew $200 per week in anticipation of partnership net income. The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a. Prepare a schedule that discloses the distribution of partnership net income for 2009. Show supporting computations in good form.

b. Prepare the statement of partners' capital at December 31, 2009.

c. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Correct Answer:

Verified

Q43: Two sole proprietors, L and M, agreed

Q46: Paul and Ray sell musical instruments through

Q49: Miller and Davis, partners in a consulting

Q50: In the AD partnership,Allen's capital is $140,000

Q52: In the AD partnership, Allen's capital is

Q53: In the AD partnership,Allen's capital is $140,000

Q59: In the AD partnership,Allen's capital is $140,000

Q60: In the AD partnership,Allen's capital is $140,000

Q65: In the JAW partnership,Jane's capital is $100,000,Anne's

Q67: Apple and Betty are planning on beginning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents