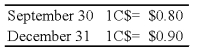

On September 30, 20X8, Wilfred Company sold inventory to Jackson Corporation, its Canadian subsidiary. The goods cost Wilfred $30,000 and were sold to Jackson for $40,000, payable in Canadian dollars. The goods are still on hand at the end of the year on December 31. The Canadian dollar (C$) is the functional currency of the Canadian subsidiary. The exchange rates follow:

-Based on the preceding information,at what dollar amount is the ending inventory shown in the trial balance of the consolidated worksheet?

A) $45,000

B) $50,000

C) $40,000

D) $35,000

Correct Answer:

Verified

Q21: On January 2, 20X8, Johnson Company acquired

Q22: On September 30, 20X8, Wilfred Company sold

Q25: The assets listed below of a foreign

Q27: Parent Company's wholly-owned subsidiary,Son Corporation,maintains its accounting

Q28: Which combination of accounts and exchange rates

Q30: The British subsidiary of a U.S.company reported

Q31: Seattle,Inc.owns an 80 percent interest in a

Q37: On October 15,20X1,Planet Company sold inventory to

Q39: On October 15,20X1,Planet Company sold inventory to

Q40: On October 15,20X1,Planet Company sold inventory to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents