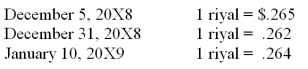

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR) , to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:

-Based on the preceding information, what journal entry would Imperial make on December 31, 20X8, to revalue foreign currency payable to equivalent U.S. dollar value?

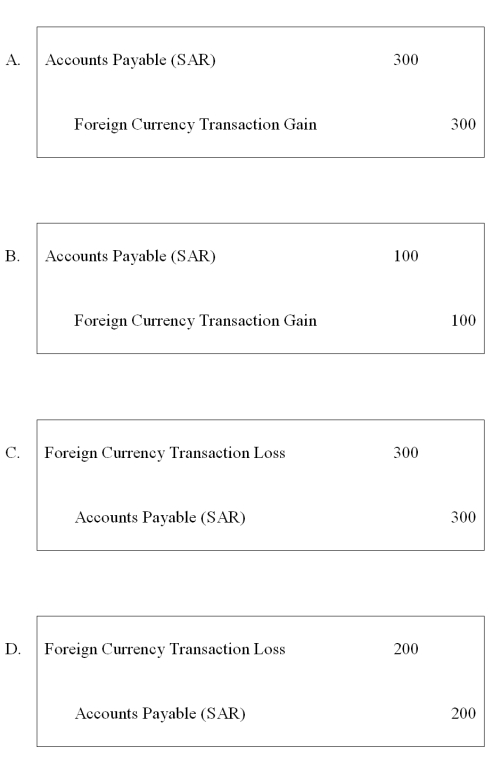

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q5: Chicago based Corporation X has a number

Q6: On December 5, 20X8, Texas based Imperial

Q6: Upon arrival in Chile,Karen exchanged $1,000 of

Q7: Spartan Company purchased interior decoration material

Q8: On March 1, 20X8, Wilson Corporation sold

Q9: Mint Corporation has several transactions with foreign

Q9: On September 3, 20X8, Jackson Corporation purchases

Q13: Suppose the direct foreign exchange rates in

Q15: Suppose the direct foreign exchange rates in

Q39: Company X denominated a December 1,20X9,purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents