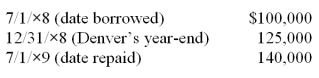

On November 1, 20X8, Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest-bearing note due on November 1, 20X9, which is denominated in the currency of the lender. The U.S. dollar equivalent of the note principal was as follows:  In its income statement for 20X9, what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9, what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

Correct Answer:

Verified

Q2: If 1 British pound can be exchanged

Q5: Mint Corporation has several transactions with foreign

Q16: Chicago based Corporation X has a number

Q17: Heavy Company sold metal scrap to a

Q20: Corporation X has a number of exporting

Q22: Myway Company sold equipment to a Canadian

Q23: The fair market value of a near-month

Q24: On December 5,20X8,Texas based Imperial Corporation purchased

Q37: Taste Bits Inc. purchased chocolates from Switzerland

Q43: On December 1,20X8,Hedge Company entered into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents