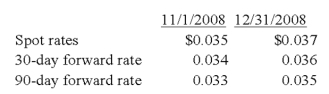

Levin Company entered into a forward contract to speculate in the foreign currency. It sold 100,000 foreign currency units under a contract dated November 1, 20X8, for delivery on January 31, 20X9:  In its income statement for the year ended December 31, 20X8, what amount of loss should Levin report from this forward contract?

In its income statement for the year ended December 31, 20X8, what amount of loss should Levin report from this forward contract?

A) $0

B) $300

C) $200

D) $100

Correct Answer:

Verified

Q22: Myway Company sold equipment to a Canadian

Q23: The fair market value of a near-month

Q31: Which of the following observations is true

Q37: Taste Bits Inc. purchased chocolates from Switzerland

Q42: On December 1,20X8,Hedge Company entered into a

Q43: On December 1,20X8,Hedge Company entered into a

Q51: Taste Bits Inc. purchased chocolates from Switzerland

Q53: The fair market value of a near-month

Q57: On December 1,20X8,Hedge Company entered into a

Q60: An investor purchases a put option with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents