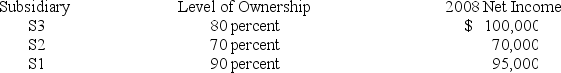

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26,20X8.This purchase followed a series of transactions between P-controlled subsidiaries.On February 15,20X8,S3 Corporation purchased the land from a nonaffiliate for $160,000.It sold the land to S2 Company for $145,000 on October 19,20X8,and S2 sold the land to S1 for $197,000 on November 27,20X8.Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 20X8.

Parent reported income from its separate operations of $200,000 for 20X8.

-Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X8?

A) $145,000

B) $220,000

C) $197,000

D) $160,000

Correct Answer:

Verified

Q15: Pancake Corporation purchased land on January 1,20X0,for

Q16: Postage Corporation receives management consulting services from

Q17: Pancake Corporation purchased land on January 1,20X0,for

Q18: A wholly owned subsidiary sold land to

Q19: Pumpkin Corporation purchased land on January 1,20X6,for

Q21: Using the fully adjusted equity method,an intercompany

Q22: Plesco Corporation acquired 80 percent of Slesco

Q23: Plesco Corporation acquired 80 percent of Slesco

Q24: Paper Corporation owns 75 percent of Scissor

Q25: Pat Corporation acquired 80 percent of Smack

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents