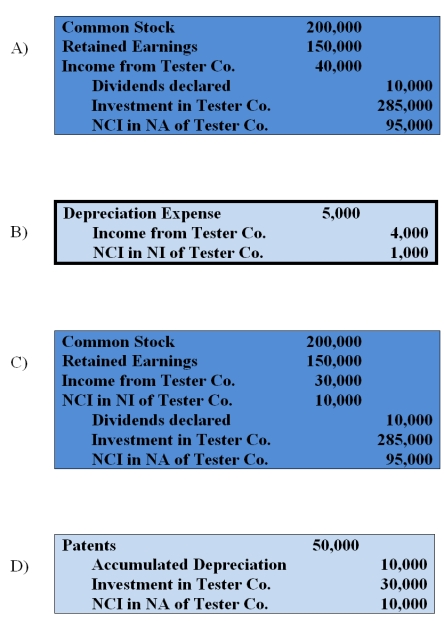

On January 1, 20X8, Ramon Corporation acquired 75 percent of Tester Company's voting common stock for $300,000. At the time of the combination, Tester reported common stock outstanding of $200,000 and retained earnings of $150,000, and the fair value of the noncontrolling interest was $100,000. The book value of Tester's net assets approximated market value except for patents that had a market value of $50,000 more than their book value. The patents had a remaining economic life of ten years at the date of the business combination. Tester reported net income of $40,000 and paid dividends of $10,000 during 20X8.

-Based on the preceding information, which of the following is an eliminating entry needed to prepare a full set of consolidated financial statements at December 31, 20X8?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q23: The following information applies to Questions 29-31

On

Q23: All of the following are examples of

Q26: The following information applies to Questions 39-40

On

Q27: On December 31, 20X8, Defoe Corporation acquired

Q30: Magellan Corporation acquired 80 percent ownership of

Q33: On December 31,20X8,Peak Corporation acquired 80 percent

Q33: When a parent owns less than 100%

Q39: The following information applies to Questions 35-26

On

Q45: On January 1,20X8,Parsley Corporation acquired 75 percent

Q46: On January 1,20X8,Parsley Corporation acquired 75 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents