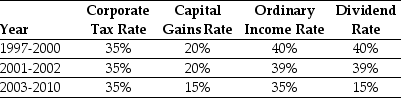

Consider the following tax rates:

In 2006, Luther Incorporated paid a special dividend of $7 per share for the 120 million shares outstanding. If Luther has instead retained that cash permanently and invested it into Treasury bills earning 5%, then the present value (PV) of the additional taxes paid by Luther would be closest to ________.

A) $42.00 million

B) $235.20 million

C) $294 million

D) $588.00 million

Correct Answer:

Verified

Q81: Iota Industries is an all-equity firm with

Q84: Firms can change dividends at any time,

Q86: Luther Industries has $7 million in excess

Q87: Prada has ten million shares outstanding, generates

Q88: Prada has ten million shares outstanding, generates

Q89: Palo Alto Enterprises has $100,000 in cash.

Q90: Prada has nine million shares outstanding, generates

Q94: The practice of maintaining relatively constant dividends

Q97: When a firm has excessive cash, managers

Q99: According to the _ theory of payout

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents