Multiple Choice

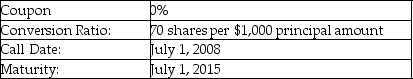

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $15.14. What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par plus 3.29%

B) par plus 3.89%

C) par plus 4.49%

D) par plus 5.98%

Correct Answer:

Verified

Related Questions

Q41: What are bond covenants?

Q43: What are the implications of stronger bond

Q61: Q61: A company issues a callable (at par) Q64: A bond has a face value of Q66: A firm issues $300 million in ten-year![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents