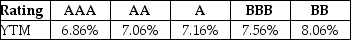

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 5.6% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:

Assuming that Luther's bonds receive a AA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

A) 27,848

B) 33,417

C) 38,987

D) 22,278

Correct Answer:

Verified

Q83: A firm issues two-year bonds with a

Q86: Use the information for the question(s)below.

Luther Industries

Q89: Use the information for the question(s)below.

Luther Industries

Q100: Q101: Luther Industries needs to raise $25 million Q102: Luther Industries needs to raise $25 million Q103: Luther Industries needs to raise $25 million Q104: Consider the following yields to maturity on Q107: Consider the following yields to maturity on Q109: Consider the following yields to maturity on![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents