Capital Budgeting Golden Flights,Inc.is Considering Buying Some Specialized Machinery,which Would Enable the Enable

Capital budgeting

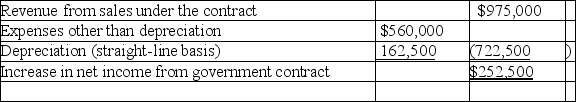

Golden Flights,Inc.is considering buying some specialized machinery,which would enable the company to obtain a six-year government contract for the design and engineering of a futuristic plane.The machinery costs $975,000 and must be destroyed for security reasons at the end of the six-year contract period.The estimated annual operating results of the project are as follows:

All revenue from the contract and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following three factors for this project:

All revenue from the contract and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following three factors for this project:

(a)Payback period: ________ years

(b)Return on average investment: ________%

(c)Net present value of the investment in this machinery,discounted at an annual rate of 12% (an annuity table shows that the present value of $1 received annually for six years discounted at 12% is 4.111): $________

Correct Answer:

Verified

(b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Capital budgeting computations

A project costing $80,000 has

Q90: Carter & Co.is trying to decide which

Q91: The accuracy of capital budget decisions is

Q92: Capital budget audit

Briefly discuss the reasons that

Q93: Capital budgeting

Flynn Corporation is debating whether to

Q95: Accounting terminology

Listed below are eight technical accounting

Q96: Appraising rate of return adequacy

What factors should

Q97: Capital budgeting

Zhang Corporation is considering investing $190,000

Q98: An investment's annual net cash flow will

Q99: Which of the following is not an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents