Exhibit 10.1

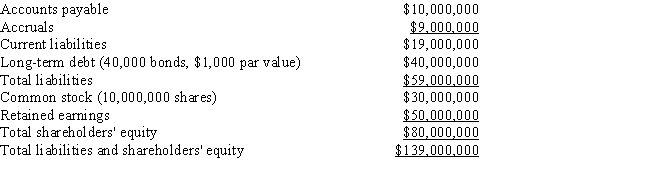

Assume that you have been hired as a consultant by CGT,a major producer of chemicals and plastics,including plastic grocery bags,styrofoam cups,and fertilizers,to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

Assets  Liabilities and Equity

Liabilities and Equity  The stock is currently selling for $17.75 per share,and its noncallable $3,319.97 par value,20-year,1.70% bonds with semiannual payments are selling for $881.00.The beta is 1.29,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

The stock is currently selling for $17.75 per share,and its noncallable $3,319.97 par value,20-year,1.70% bonds with semiannual payments are selling for $881.00.The beta is 1.29,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 10.1.Which of the following is the best estimate for the weight of debt for use in calculating the WACC?

A) 16.56%

B) 17.23%

C) 17.57%

D) 17.92%

E) 18.64%

Correct Answer:

Verified

Q67: You were recently hired by Scheuer Media

Q68: Which of the following statements is CORRECT?

A)

Q69: To help finance a major expansion,Castro Chemical

Q77: Weaver Chocolate Co.expects to earn $3.50 per

Q79: O'Brien Inc.has the following data: rRF =

Q81: The CFO of Lenox Industries hired you

Q83: Exhibit 10.1

Assume that you have been

Q84: Bolster Foods' (BF)balance sheet shows a total

Q88: Exhibit 10.1

Assume that you have been

Q94: Exhibit 10.1

Assume that you have been

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents